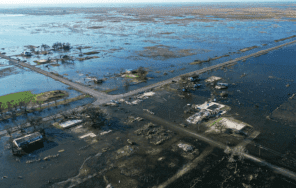

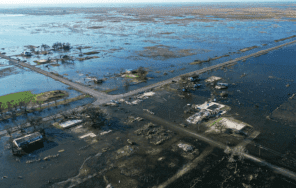

When Should I Get Flood Insurance, and What Is It?

Flood Protection?” or Flood Insurance,

The only thing worse than experiencing a catastrophic event is living through it.

What if you suffer a loss, such as the value of your home going down, and find out that your property owner’s insurance won’t pay for it?

Getting the right coverage to protect your home and belongings is crucial.

Protection for mortgage holders is a fantastic starting point, but you should also consider getting flood insurance.

Answering the Question, “What Is Flood Protection?” or Flood Insurance,

Comparing the Educational Systems of the United Kingdom and the United States

Property owners in vulnerable areas can get flood insurance.

It’s separate from your property owner’s protection policy, but it covers everything a flood could throw at you.

The policyholder of a flood insurance policy can claim compensation for any losses sustained due to flooding, regardless of the cause.

When people think of natural disasters that have occurred in the United States, they often think of floods.

The Government Crisis Board Organization estimates a 26% chance of experiencing a flood sometime during a 30-year contract (FEMA).

Unfortunately, regular mortgage insurance policies do not typically cover these losses entirely or even partially.

Shah Rukh Khan Pathaan Earned Rs 100 Crore,

If the flooding was caused by a covered peril specified in your insurance policy with your mortgage lender, the insurer might pay for some of the resulting damage.

Remember the conditional language of “may” and “if” in that last sentence.

If a leading water pipe bursts and floods your home during an ice storm, for instance, you would be compensated for the structural damage but probably not the personal effects inside the house; your insurance would cover the former.

But if a storm causes flooding, the protections afforded to property holders are useless.

Do We Need to Take Precautions Against Flooding?

Your mortgage lender may insist you get flood insurance if you buy a home in a high-risk area.

Buying a home in a high-risk flood area with federal, state, or local government assistance is subject to a mandated requirement that the buyer obtain flood insurance.

Suppose your home is in an average to high-quality location; what then?

You are not mandated by law to purchase flood insurance, but your lender may insist that you do so.

You may also decide that, in light of the exceptional weather of recent times, you are not willing to risk flooding.

Different Social Consequences of Divorce in Pakistan

Have you considered Flood Insurance?

According to FloodSmart.gov, a government crisis board authority site, and Public Flood Protection Program resource, floods can occur anywhere it rains (NFIP).

It should be emphasized that a mere increase of one inch in water level can result in significant destruction, with expenses for repairs potentially reaching as high as $25,000.

In a high-risk flood zone, you have a one-in-four chance of experiencing flooding at some point during the term of your 30-year mortgage.

Your loan officer will probably insist you get flood insurance because of the high risk of flooding.

The Secrets of Education 13 Advices by Achievers

Homeowners in Acceptable Areas

Although just because you are located in a lower-risk area does not mean you do not need flood insurance.

Mortgage holders outside high-risk flood areas accounted for 33% of government flood catastrophe aid disbursed in that period, recording more than 40% of NFIP flood protection assets.

You are aware of your risk tolerance.

Thankfully, flood insurance costs are significantly reduced in areas that are less prone to flooding, so the peace of mind it provides may be worth the extra money.

You can use the FloodSmart flood damage calculator to understand the potential consequences of even a tiny water level rise.

Here are the Five Parenting Styles We’re Embracing in 2023

Perils Can Evolve

You probably shouldn’t be too shocked if you’re in one of these relatively secure areas.

A little while later, your lender mentions that you need flood insurance.

The risk of flooding in your neighborhood is rising because flood maps are constantly updated.

Guides for flooding can be modified in three ways:

The first step was taken by FEMA, as FEMA now provides funding for permit modifications.

Second, communities have taken the initiative to adjust as networks try to correct FEMA’s inaccurate or incomplete maps.

Third, a Collaborating Specialized Accomplices Push that uses state and local assets to cultivate more precise data to advance sustainably.

The maps produced by the Federal Emergency Management Agency are highly reliable and accurate. They are an invaluable resource for those who need to be prepared for natural disasters and emergencies.

Our maps are designed to provide you with the most accurate and relevant information, ensuring that you are equipped to make informed decisions. We are committed to keeping our maps up-to-date and useful, so you can always rely on our service to provide you with the information you need.

Anyone looking for a reliable source of information on emergency preparedness should definitely consider using these maps.

What are the Fast Fashion Problems? A Short Discussion

Many Different Methods of Flood Defense

There are two primary categories of flood insurance: the National Flood (NFIP) and private flood insurance.

More research into the two options is necessary before we can say which is better for your house.

Governmental Efforts to Reduce Flood Damage

Federal Emergency Management Agency (FEMA) presents and maintains NFIP nationally.

Flood insurance from the NFIP is available for purchase by homeowners, business owners, and even lessees in eligible networks.

So, What Does NFIP Pay For?

It is crucial to examine the specifics of this flood protection.

The National Flood Insurance Program can cover extensive flood damages with the right arrangement.

Rest assured that any damages your property may incur during the installation of sewer reinforcements will be covered by the NFIP.

Oscar-Winning Actor Brad Pitt Short Life Story

The following are included as part of NFI P’s contents:

Personal effects (such as furnishings, clothing, hardware, and window coverings); household appliances (such as dishwashers, washing machines, and microwave ovens); one-of-a-kind works of art

The Contents of Coolers (fridges are excluded)

The following are included in NFIP coverage for buildings:

• Heating, electrical, and plumbing infrastructures

- Drain sumps, water sumps, and radiator drains

Explicit fixtures such as shelving, framing, wallboard, and cabinets, as well as explicit appliances such as refrigerators, dishwashers, and ovens.

Simple window coverings; Stairs; Walls; Enclosed Parking

What is The Relationship Between Grains And Heart Disease

How Much Is NFIP Insurance?

According to FEMA, the annual cost of flood protection in the United States averages between $800 and $1,200.

Please keep in mind that the coverage area can vary based on different types of factors, including your location, the risk of flooding, the amount of deductible, the extent of your policy, and any additional coverage you may have purchased, such as contents or structure coverage.

How Inclusive Is the Public Flood Protection Program?

If you’re wondering if FEMA’s NFIP will adequately cover your home, the answer depends on your specific needs.

The NFI P’s restrictions will give us a better idea of what is not covered.

The National Flood Insurance Program does not pay for damages to privately owned structures caused by:

Tastiest Apple Dumplings Recipe; Dumplings Filled With Apples

If your home or business:

• Has a price tag of more than $250,000 (including both the building itself and its contents);

• Was damaged due to mold or buildup that you could have avoided; or

• Was not directly caused by flooding.

• Is caused by evolution on Earth, whether or not the underlying change results from rising sea levels.

If you anticipate needing more coverage than the NFIP provides, you may want to consider purchasing private flood insurance in addition to or in place of your NFIP policy.

Safety from Unseen Floods

To provide flood security, private insurance agencies can either provide National Flood Insurance Program (NFIP) plans, reinsure NFIP plans, or take on the risks and responsibilities of damage mitigation by selling private flood insurance contracts.

Here Are The Dietitian-Recommended Stress Relief Food

In most private flood insurance contracts, businesses with valuable equipment or inventory or homeowners whose homes have a replacement cost of more than $250,000 are the primary beneficiaries of business property inclusion and optional inclusion.

Besides the National Flood Insurance Program (NFIP), confidential guarantors may provide flood protection plans through its Compose Your Program.

The reality is that you must have flood protection to keep your property safe.

The mortgage company’s insurance will cover many potential disasters affecting your home.

However, you must have a flood insurance policy in place in a natural disaster such as a typhoon, hurricane, or excessive rainfall that causes flooding.

For more detail click here,